Artificial Intelligence (AI) is revolutionizing various industries and one area where its impact is increasingly felt is in crypto analysis. With the growing complexity and volatility of cryptocurrency markets, traditional methods of analysis have proven inadequate. However, Artificial intelligence-driven data analysis has emerged as a game-changer, providing valuable insights and improving decision-making processes. In this blog post, we will delve into the trends and developments of it in crypto analysis, exploring how it is shaping the future of cryptocurrency investments.

Overview of AI-driven data analysis in cryptocurrency markets

Source:facebook.com

AI algorithms are powering data analysis in cryptocurrency markets, enabling the extraction of meaningful information from vast amounts of data. These algorithms can swiftly analyze market trends, historical patterns, and other relevant factors to generate valuable insights. By leveraging machine learning techniques, Artificial intelligence can identify correlations and anomalies that may be difficult for human analysts to spot. Moreover, AI can process large datasets in real time, providing up-to-date and accurate information for making informed investment decisions.

Utilizing AI algorithms for predictive price analysis in crypto

One of the key applications of AI in this analysis is predictive price examination. AI algorithms can analyze historical price data, market trends, social media sentiment, and other relevant factors to predict future price movements with a considerable degree of accuracy. These predictive models enable investors and traders to anticipate market shifts, identify profitable entry and exit points, and optimize their trading strategies. By leveraging AI-driven predictive price investigation, investors can gain a competitive edge in the volatile world of cryptocurrencies.

The role of natural language processing in sentiment analysis

Natural Language Processing (NLP) is a branch of AI that focuses on understanding and processing human language. In the context of crypto analysis, NLP plays a crucial role in blockchain analysis. By analyzing social media feeds, news articles, and other sources of information, NLP algorithms can gauge public sentiment toward cryptocurrencies. This sentiment analysis helps investors assess market sentiment, identify emerging trends, and make informed decisions based on the collective mood of the market.

Machine learning techniques for identifying market patterns and trends

Source: mygreatlearning.com

Machine learning techniques are at the core of AI-driven analysis. These techniques enable the identification of complex patterns and trends in markets, which may not be apparent to human analysts. Machine learning algorithms can recognize subtle correlations between various market factors, allowing for the detection of recurring patterns and the prediction of market movements. By leveraging these techniques, investors can make data-driven decisions and stay ahead in the dynamic digital money landscape.

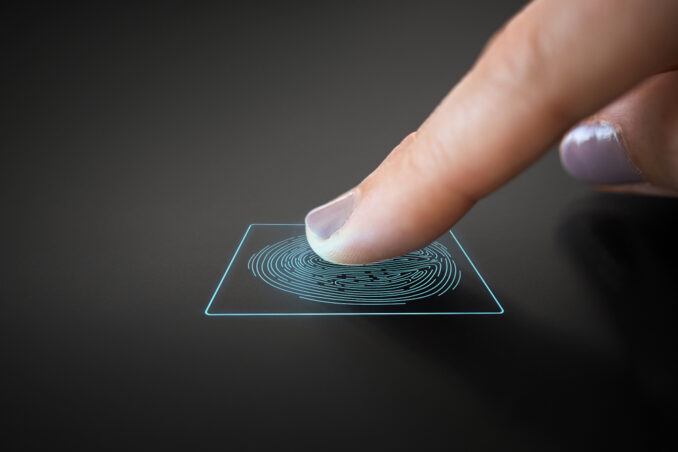

AI-based risk assessment and fraud detection in crypto transactions

The decentralized nature poses unique challenges when it comes to risk assessment and fraud detection. However, Artificial intelligence has proven to be invaluable in addressing these challenges. AI algorithms can analyze transactional data, network behavior, and other relevant factors to identify suspicious activities and potential fraud. By continuously monitoring transactions and patterns, Artificial intelligence can detect anomalies in real-time, mitigating the risk of fraud and enhancing the security of transactions.

Exploring the potential of AI in automated trading strategies

Automated trading strategies are gaining popularity in the market, and AI plays a significant role in their development and implementation. AI-powered trading bots can analyze market data, execute trades, and adapt strategies based on real-time market conditions. These bots can operate 24/7, taking advantage of opportunities that may arise at any time. By leveraging AI in automated trading, investors can reduce emotional biases, optimize trade execution, and potentially generate higher returns.

Enhancing security and privacy in crypto with AI-powered solutions

Security and privacy are critical concerns in the world of digital money. AI-powered solutions offer promising ways to address these challenges. AI algorithms can analyze blockchain data and network behavior to identify potential vulnerabilities and anomalies in real time. By proactively detecting and responding to security threats, Artificial intelligence can help prevent unauthorized access, data breaches, and fraudulent activities. Additionally, Artificial intelligence can enhance privacy by developing advanced encryption techniques and anonymization protocols, allowing users to safeguard their identities and transactional information while participating in the crypto ecosystem.

AI-driven portfolio management tools for cryptocurrency investors

Source: seekingalpha.com

Managing a diverse portfolio of cryptocurrencies can be a daunting task, but Artificial intelligence-driven portfolio management tools are simplifying the process. These tools utilize AI algorithms to analyze market data, assess risk, and optimize portfolio allocations. By considering various factors such as historical performance, market trends, and risk tolerance, Artificial intelligence-powered tools can suggest optimal investment strategies tailored to individual investors. Moreover, these tools can provide real-time monitoring and notifications, enabling investors to make timely adjustments to their portfolios based on market conditions.

Challenges and prospects of AI in crypto analysis

While the potential of it in crypto analysis is vast, several challenges need to be addressed. One significant challenge is the availability and quality of data. These algorithms heavily rely on large and high-quality datasets, which may be limited in the crypto space. Additionally, the evolving regulatory landscape and potential ethical considerations surrounding it in crypto analysis need careful attention.

Looking ahead, the prospects of it in the crypto analysis are promising. As technology advances, Artificial intelligence algorithms will become more sophisticated, enabling deeper analysis and better predictions. Moreover, collaborations between these experts, blockchain developers, and financial institutions will likely lead to innovative solutions that further enhance the accuracy and efficiency of these analyses. As Artificial intelligence continues to evolve, it will undoubtedly play a crucial role in shaping the future of cryptocurrency investments.

Conclusion

In conclusion, AI is increasingly influencing crypto analysis by revolutionizing data analysis, predictive price analysis, sentiment examination, risk assessment, fraud detection, automated trading strategies, security, privacy, and portfolio management. The integration of Artificial intelligence algorithms provides valuable insights, improves decision-making processes, and helps investors navigate dynamic and volatile markets. While challenges exist, the prospects of AI in crypto analysis are bright, and the continued development and adoption of artificial intelligence technologies will undoubtedly shape the landscape of cryptocurrency investments in the years to come.