The prospect of investing in Singapore’s property market has long intrigued investors globally. This vibrant city-state, known for its economic prowess and political stability, presents a unique opportunity for long-term property investment. This blog post aims to explore the viability of such investments, offering insights into the Singaporean real estate market, its potential benefits, and the challenges investors might face.

Singapore’s Property Market Overview

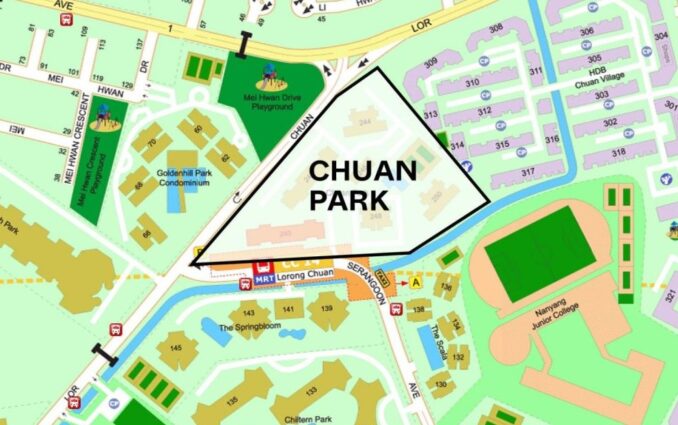

Singapore’s property market stands as a beacon of stability and growth in Southeast Asia. Recent trends show a consistent rise in property prices, with a noticeable increase in rental yields. These statistics reflect the city-state’s robust market appeal. Singapore has established itself as a preferred destination for real estate investment, thanks to its stable economy and strategic location, which bolsters its real estate market’s resilience and attractiveness. This is what gave birth to The Chuan Park.

Factors Favoring Property Investment in Singapore

Several compelling factors make Singapore an attractive destination for property investors. The country’s strong and diverse economy is a significant draw, providing a stable backdrop for property investments. Additionally, Singapore’s political climate is one of the most stable in the world, offering a sense of security to investors. The transparent legal system further enhances this appeal, ensuring clear and fair real estate transaction processes. Government policies, including investment incentives, also play a pivotal role in encouraging real estate investments, making Singapore a top choice for those looking to invest in real estate for the long haul.

Potential Challenges and Risks

While the allure of investing in Singaporean property is undeniable, it’s crucial to consider the potential challenges and risks. The government has implemented various property cooling measures to prevent market overheating, which could impact investment returns. Property taxes and stamp duties might also affect overall profitability. Furthermore, like any real estate market, Singapore’s is subject to fluctuations and market volatility. A thorough understanding of these risks is essential for making an informed investment decision.

Types of Properties in Singapore

Source:99.co

Singapore offers a diverse range of property types, each with its unique advantages and considerations. Condominiums are popular among investors for their amenities and potential rental yields. Landed houses, although more expensive, offer the allure of exclusivity and space. Commercial properties can provide higher rental yields but might require more significant capital and understanding of commercial market trends. Understanding the nuances of each real estate type is crucial in aligning investment choices with individual goals and preferences.

Long-Term Investment Strategies

For those eyeing long-term gains in Singapore’s property market, strategic planning is key. Factors such as location, potential for rental income, and real estate type diversity should guide investment decisions. It’s also important to consider financing options and the importance of conducting thorough due diligence. A long-term perspective will likely involve looking at properties with growth potential in developing areas or those that offer stable rental incomes in established neighborhoods.

Conclusion and Takeaways

Source: colliers.com

In conclusion, investing in Singapore’s property market can be a viable long-term investment strategy, but it requires careful consideration and planning. The market’s stability, strong economy, and transparent legal framework are significant draws. However, potential investors must also weigh the challenges and risks involved, including government cooling measures and market volatility. Choosing the right type of real estate and adopting a strategic approach to investment can lead to fruitful long-term gains.