For start-ups, effective expense management is essential to success. With so many moving parts and limited resources, it’s important to have a system in place to track and manage expenses. The good news is, there are a number of excellent expense management software options available for startups. From cloud-based solutions to mobile apps, we’ve got you covered. So if you’re looking for a way to streamline your startup’s expense management, read on for our top picks.

What is expense management software?

Source:kendomanager.com

Expense management software helps startups keep track of their spending and save money. The software can be used to manage expenses for a single person or a whole team.

There are many different software programs available, so it’s important to choose one that meets the specific needs of your startup. You can find out more at blog.happay.com. Some things to consider when selecting the software include the number of users, ease of use, cost, and features.

Some common features include:

- Expense tracking: This feature allows businesses to track employee spending in real time. This can help businesses keep tabs on spending and prevent unauthorized expenditures.

- Reporting: This feature allows businesses to generate reports on employee spending. Reports can be used to identify spending trends or problem areas.

- Reimbursement: This feature allows businesses to reimburse employees for authorized expenditures. Reimbursement can be done electronically or through paper checks.

This software typically includes features such as tracking and categorizing expenses, creating budgets and generating reports. If you are looking for the best expense management software uk, visit here.

How can expense management software help startups?

Source:pinterest.com

There are a number of ways in which expense management software can help startup businesses. Perhaps the most obvious way is by helping to keep track of expenses. This can be extremely helpful for startups, as they often have a lot of expenses and may not have a dedicated accounting or finance team to track everything. Having all expenses in one place can help ensure that nothing gets missed and that the business has a clear picture of where its money is going.

Another way that this kind of software can help startups is by providing insights and reports into spending patterns. This information can be invaluable for making informed decisions about where to allocate resources. For example, if a startup sees that it is spending a lot on travel, it may decide to cut back on unnecessary trips or invest in more cost-effective methods of transportation.

Finally, expense management software can also help improve compliance with tax and regulatory requirements. This is especially important for startups, as they may not have the manpower or experience to deal with complex filing requirements. Automating these processes can save the business time and money, and reduce the risk of non-compliance penalties.

How to choose the right expense management software for your startup

When it comes to choosing the right expense management software for your startup, there are a few things you need to take into account. First and foremost, you need to make sure that the software is user-friendly and easy to use; after all, you don’t want your employees wasting valuable time trying to figure out how to use the system. Secondly, you need to make sure that the software integrates seamlessly with your existing accounting software; this will save you a lot of headaches down the line. Lastly, you need to make sure that the price is right; while you don’t want to skimp on quality, you also don’t want to overspend on something that your startup may not even need in the long run.

The 5 best expense management software options for startups

When it comes to running a startup, every penny counts. That’s why it’s so important to have a good expense management system in place. With the right software, you can keep track of your spending, save money, and avoid costly mistakes.

There are a lot of different software options out there, so it can be tough to know which one is right for your startup. To help you out, we’ve put together a list of the five best expense management software options for startups.

1. Expensify

Source:pinterest.com

Expensify is a great option for startups because it’s simple to use and easy to set up. It also offers a lot of features, such as the ability to track expenses by project, create custom reports, and integrate with accounting software. Best of all, it has a free plan that gives you access to all of these features.

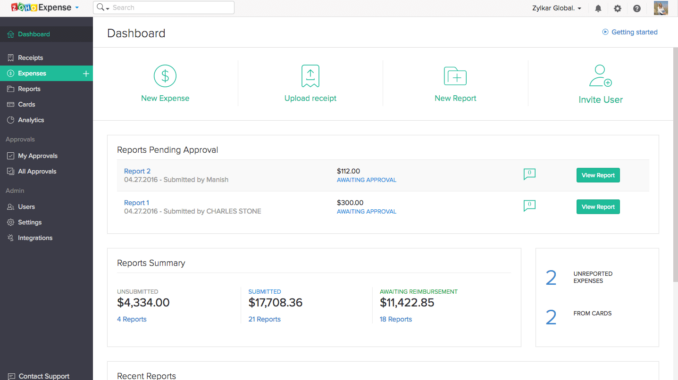

2. Zoho Expense

Source:pinterest.com

Zoho Expense is another excellent choice for startups. Like Expensify, it’s easy to use and offers robust features like expense tracking by project and integration with accounting software. It also has a free plan that includes all of these features plus some extras like receipt scanning and automated approval workflows.

3. Wave Accounting

Source:facebook.com

Wave Accounting is a good option for startups because it offers basic expense tracking features for free. If you need more advanced features, such as the ability to track expenses by project or create custom reports, you can upgrade to Wave’s paid plans.

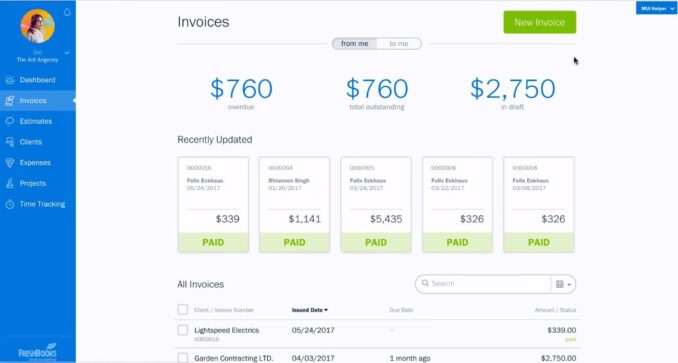

4. FreshBooks

Source:youtube.com

FreshBooks is a good choice for startups because it offers simple expense-tracking features and integrates with accounting software. It also has a free plan that gives you access to all of these features plus some extras like invoicing and time tracking.

5. Xero

Source:amoura.com.au

Xero is a great option for startups because it offers a free trial and comprehensive features, such as the ability to track expenses by project, create custom reports, and integrate with accounting software.

Final Words

Source:itilite.com

If you’re a startup, finding the right expense management software is crucial to your success. With so many options on the market, it can be tough to know where to start. That’s why we’ve put together this list of the best expense management software for startups in 2024. From cloud-based solutions to apps that help you track your spending, there’s something on this list for every startup. So take a look and see which one is right for you.