If you have a Wells Fargo checking account, you may wonder how long it takes to get charged an overdraft fee. Overdraft fees are charged when you use more money than you currently have in your account. This can happen if you forget to deposit money, make a mistake with your math, or have a recurring bill that comes out unexpectedly.

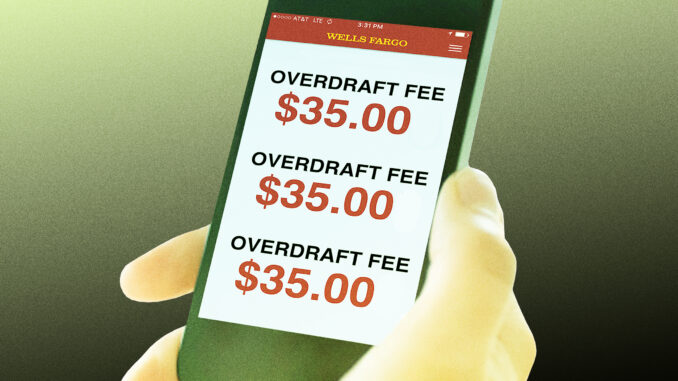

The current overdraft fee at Wells Fargo is $35 per item. This means that every time you purchase or withdraw money from an ATM when you don’t have enough money in your account, you will be charged $35. Unfortunately, many people have faced an excessive overdraft fee from Wells Fargo, and in this article, we will examine how you can fight back.

What are predatory overdraft fees, and can you sue?

Source: phillipslaw.com

Predatory overdraft fees are excessive fees banks charge customers for overdrawing their accounts. These fees are often charged for each transaction that exceeds the account balance and can quickly add up to hundreds of dollars in fees for customers struggling to make ends meet. Predatory overdraft fees have been criticized for impacting low-income and vulnerable consumers, who are more likely to face financial hardships and may be disproportionately affected by these fees.

The practice of charging predatory overdraft fees has been the subject of lawsuits and regulatory action in recent years. In 2010, the Federal Reserve implemented rules requiring banks to obtain customer consent before enrolling them in overdraft programs. This was in response to complaints that some banks automatically enroll customers in these programs without their knowledge and then charge excessive fees.

However, many banks still charge high overdraft fees, and some consumers have turned to legal action to challenge these fees. One strategy that has been successful in some cases is to file a class-action lawsuit against the bank. In a class-action lawsuit, a large group of consumers can band together to challenge a company’s practices, which can be more effective than filing an individual lawsuit.

How To Fight Wells Fargo Overdraft Fees

Source: vice.com

In recent years, several class-action lawsuits have been filed against banks for charging excessive overdraft fees. In some cases, these lawsuits have resulted in settlements in favor of the plaintiffs. This is true for an excessive overdraft fee Wells Fargo.

If you believe that you have been charged predatory overdraft fees by your bank, you may have legal options. One option is to file a complaint with your state’s attorney general or a banking regulator. These agencies can investigate your complaint and take action if they find evidence of wrongdoing. Another option is to speak with a consumer rights attorney who can advise you on your legal options. An attorney can help you determine if you have a strong case and can assist you with filing a lawsuit if necessary.

Additionally, If you have been charged an excessive overdraft fee from Wells Fargo, you may be eligible to join a class-action lawsuit. To do so, you must find a law firm pursuing such a case against the bank and submit your claim. The law firm will then evaluate your claim to determine if you can join the lawsuit.

Fight Back Against An Overdraft Fee From Wells Fargo

Source: forbes.com

In conclusion, Wells Fargo has been the target of several class-action lawsuits related to its overdraft fee practices. If you believe you have been the victim of excessive overdraft fees by the bank, you may be eligible to join a class-action lawsuit or pursue legal action with the help of a consumer rights attorney.