The end of the year is always an active time for small business owners. You’re organizing your finances, preparing to file your taxes through CRA, and planning for next year. But while you’re wrapping up this year’s books, remember all the other small business tax deadlines coming up in the following year. We’ve put together a list of items you should know about these important dates to stay on top of your game.

What is the HST?

Source:djb.com

The Harmonized Sales Tax (HST) is a combined federal and provincial tax on purchasing most goods and services in Canada. It’s also known as a value-added tax in other countries. The HST applies to most retail sales in all provinces except Alberta, Saskatchewan, Manitoba and Quebec.

The HST applies only to the final price of an item or service purchased at retail; it does not apply to wholesale purchases, which may be subject to GST or PST, depending on where you are located in Canada.

Provincial business grant programs

If you’ve got a small business in Canada and are looking for ways to take it to the next level, you should know that many provincial governments offer business grant programs to help you do that.

In addition to the federal government’s Canada Small Business Financing Program, which provides financial assistance for all small business projects, several provincial programs are also available.

Small business tax write-offs

Small business owners can also write off expenses that help their business run, such as:

- Office Supplies

- Software

- Equipment, including computers and machinery

- Rental properties (if you use them to run your business)

- Advertising costs (such as newspaper ads or Facebook ads)

If you have inquiries about the kinds of things qualify for tax deductions or how much you can deduct, contact the Canada Revenue Agency for more information.

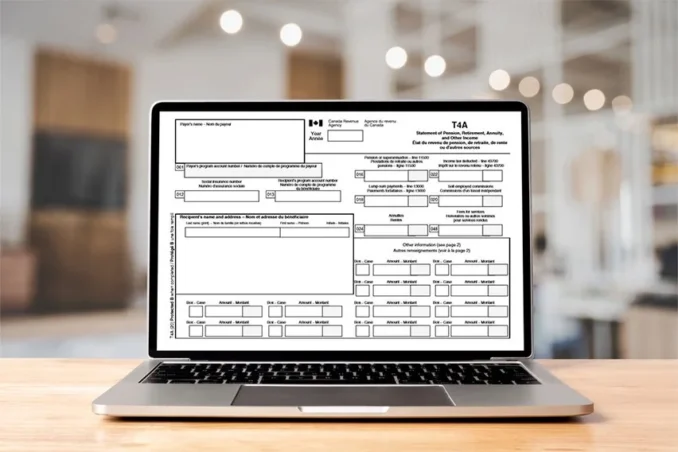

What is a T4?

Source:freshbooks.com

T4 is a tax form employers in Canada use to report the income and expenses of their employees.T4 is also used by self-employed people, such as contractors or consultants, to report their net income earned from business activities.

If you are not a Canadian resident for tax purposes, you can claim an exemption from withholding taxes on payments made to you by your employer. In this case, you will have to file a separate T4A (Statement of Exempt Income) instead of a regular T4 slip.

Keeping your small business organized

Keeping track of your small business income and expenses is one of the most critical aspects of running a profitable company. You can’t accurately report your taxes without this information, so you must keep it organized and accurate.

If you want to be sure you get all small business tax deadlines when filing your taxes, it’s best to start keeping records immediately. The following are some tips for organizing your small business finances:

There are several tax-related deadlines you should keep in mind

There are several tax-related deadlines you should keep in mind.

- HST Payable. If you’re a small business owner, you must know when and how much taxes you owe. Keep an eye out for small business tax deadlines related to GST/HST and PST payments, and remit these taxes to the federal government and your provincial government(s).

- Provincial Business Grant Programs. Suppose your business is located in Quebec or Manitoba. In that case, provincial programs may be available that reward small businesses with financial support through grants or loans without asking for repayment or at least with minimal payments back over time on any funding provided by the province itself through its economic development department (EDD).

Conclusion

Source:usnews.com

The most important thing to remember is that you don’t have to do this alone. There are many resources available online, from government websites and online tax software programs. If you need help filing your taxes or understanding what they mean, we can help!